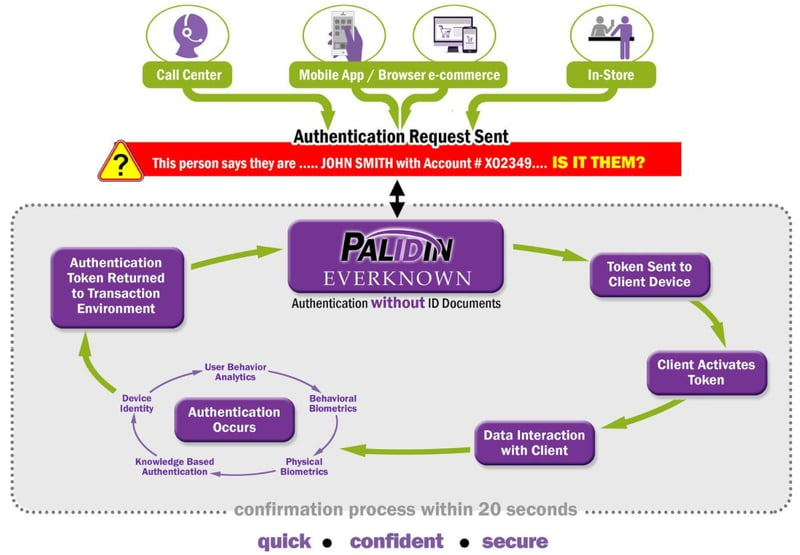

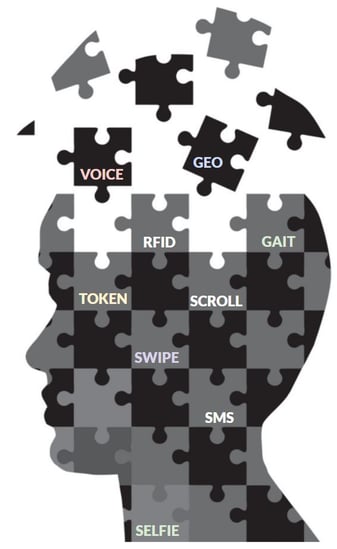

EVERKNOWN is our modular solution that utilizes covert and overt authentication

techniques to enable future authentications of individuals’ identities without needing to

review their physical ID document.

EVERKNOWN allows organizations to move trusted individuals towards future

authentication methods that are cost effective, speedy and unobtrusive. EVERKNOWN

can confirm identity covertly, without the individual having any conscious interactions,

while in other cases, users may submit fingerprints, voice-prints, facial images, or be

required to type a phrase or click on a link.

______________________________________________________________

ONE-ON-ONE LIVE PALIDIN DEMO

Below, you can schedule a one-on-one PALIDIN demo to experience the industry's most effective

identity fraud prevention for financial services organizations. We'll discuss your specific fraud

prevention needs and you'll experience how banks and other FI's are using PALIDIN to prevent

fraud as well as gain innovative visibility and insights into fraud activity / trends.

Prevent Fraud resulting from Fraudulent IDs, Identity Theft, Account Takeovers

Optimize Customer Experience | Provide Frictionless Transactions: Loan Origination & Credit Applications

Meet Compliance Regulations (KYC / AML, Patriot Act, BSA, PSD2, CIP)