CNP to Hit $70 Billion in the Next 5 Years

Retailers are on course to lose more than $70 billion globally to remote “card-not present” (CNP)...

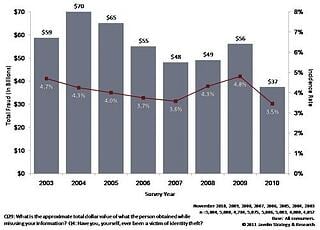

As highlighted in last week's article "The underground market for IDentity Data (Part I)", the Internet's black market for stolen identity and financial portfolios affects tens of millions of people in America and internationally. In the past year alone, more than 1.2 billion personal credentials, usernames and passwords, banking information, utility bills, and more were hacked from leading corporations and institutions across virtually every industry in the world. Additionally, many personal and small business websites were breached by organized underground hackers' and the identity theft industry.

In today's age of digital duplication technologies and the cloak-and-dagger anonymity the Internet affords to potential criminals, a company's approach to loss-prevention (LP) must extend beyond traditional strategies. Now, it is required that front-line "retail" level employees be equipped for detecting fake identification documents and the instant detection of counterfeit currency, credit and debit cards, bank checks, and traveler's checks. Whether via online purchases, POS transactions, or wire transfers, every company is potentially vulnerable and, sooner or later, vulnerabilities will be exploited.

Read on to learn how you can protect your company's assets and reputation by identifying vulnerabilities, leveraging cost-effective forgery detection solutions, and implementing your LP strategy with proper employee training.

A single network breach at a major corporation has the potential to put thousands of companies and millions of consumers at risk of being victimized by identity theft and fraudulent transactions. Such breaches have become the "norm", at healthcare companies, big box stores, internet service providers, search engines, social websites, government websites, banking and financial institutions, and so on. For many of these operations, they are completely unaware that maliscious software is tucked away snug-as-a-bug inside their network security software itself until they are notified by the victims.

In the aftermath of a breach, it seems the acceptable action to be taken by the hacked company is to offer a one-year "free" subscription to online identity fraud monitoring. Not much comfort to the ID theft victim who must spend months (or even years) attempting to recover from the damage.

Often the biggest victims of identity theft, counterfeiting, and fraud are the companies that provide goods and services in exchange for worthless counterfeit payments. Loss prevention is undermined when digitally-reproduced "authentic" ID's are presented in stores in order to apply for credit, utilize credit cards, or access customer accounts. For many of these companies, the only defense may be a busy employee's gut feeling and, "Thank you and have a nice day."

In the end, companies with loopholes in their loss prevention efforts are as vulnerable as corporate network systems with loopholes in their security.

The best loss prevention solution for any given company or institution is going to be unique—even among companies in the same industry. Regardless of whether a business operates a single location or an international chain - the local environment will dictate the threat-level, which is never going to be exactly the same from one business to the next.

Similarly, each customer and transaction is unique, which creates vulnerabilities according to the specifics of every individual event. Just buying an out-of-the-box fraud prevention solution may not be the best course of action to take. For example, a business owner with a chain of retail stores, hotels or markets spread across a large metropolitan area will surely have high-risk "fraud problem" locations, which may be budgeted primary loss prevention resources. Fraud and counterfeiting problems may virtually disappear where the fraud-fighting equipment was implemented. Yet, invariably, the criminals simply move their fraudulent operations to the lower-risk locations that didn't implement fraud-fighting LP measures.

This "Displacement Effect," as it were, is addressed through identifying the points of vulnerability unique to each brick-and-mortar location or online outlet. Then, implementing your unique fraud prevention plan involving multi-layered solutions. The "multi-layered" approach to fraud prevention is a strategy of putting the proper level(s) of fraud detection equipment, according to the potential loss. In high-risk environments, higher-cost equipment may be justified, while lower-risk or lower-dollar-value transaction locations may justify simpler, lower cost equipment. This enables both cost-effective use of scarce budget dollars, while maintianing the highest level of vigilance.

The implementation of your unique multi-layered solution and the training and resources provided your employees ultimately prescribes the success or failure of your LP efforts. For instance, just as you train your employees to provide good customer service, your employees should be trained to provide a service to your good customers. This is accomplished by training employees to use fraud-fighting equipment proficiently in identifying and halting fraudulent transactions. You minimize your bottom-line losses to fraud and counterfeiting, and you maximize your company's offerings and value to your valued customers.

Engage a proven LP solution company that works closely with you to develop and implement the right multi-layered Design Solution exacting to your company's needs. Training and implementation resources should be readily available, which might include online resources for cross-referencing out-of-state driver's licenses, for example, automated counterfeit detection scanners of up to eight foreign notes, and UV light verification products.

Consider that the more confident and capable your employees feel about using your company's LP equipment, the more likely they are to use the equipment and resources successfully. Make sure your company's assets and vulnerabilities are covered with an Multi-Layered Fraud Prevention solution unique to your needs. Contact FraudFighter today for more information about identity theft and preventing fraudulent transactions.

Retailers are on course to lose more than $70 billion globally to remote “card-not present” (CNP)...

Leave a Comment